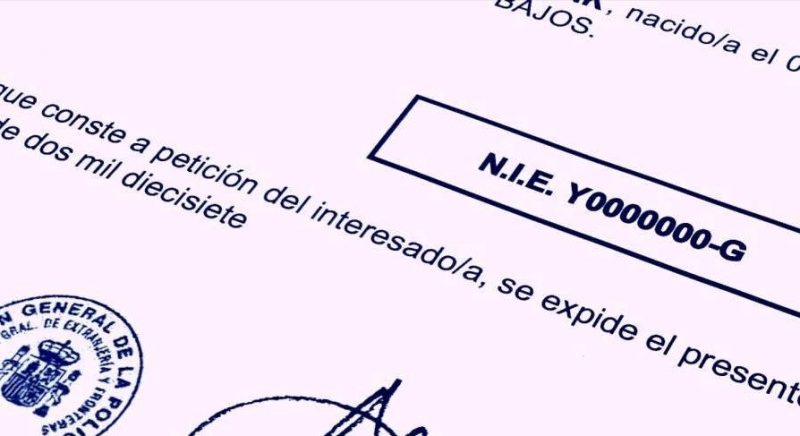

The NIE is the Identification Number for Foreigners .

All those natural or legal persons with economic or professional interests in Spain or with a relevant implication for tax purposes must have a NIF (in the case of legal persons) or NIE (individuals).

Specifically, and among other cases, the NIF/NIE must be requested whenever a foreigner wants to buy or set up a company in Spain.

The NIE must also be requested when the foreigner is going to act as administrator of an entity resident in Spain or of a branch or a permanent establishment located in Spain of a foreign entity.

The personal number will be the foreigner’s identifier, which must appear on all the documents that are issued or processed, as well as the procedures that are stamped on their identity card or passport.

How is the NIE requested?

The assignment of NIE or Foreigner Identification Number for reasons of economic, professional or social interests, may be requested in the following ways:

- In Spain, personally by the interested party

- In Spain, through a proxy or representative

- At the Spanish Consular Offices located in the applicant’s country of residence, corresponding to their demarcation of residence.

What documents are necessary to apply for the NIE?

For the assignment of the NIE or Foreigner Identification Number, the following documents must be provided:

- Standardized application form (EX-15), duly completed and signed by the foreigner.

- Rate 790

- Original and copy of the complete passport, or identity document, or valid travel title or registration card.

- Communication of the economic, professional or social reasons that justify the request.

- When it is requested through a representative, he/she will certify having sufficient power of attorney expressly stating that he/she is empowered to submit such request *.

* In case of foreign documents, these must be duly legalized and translated.